Napoleon once said, “An army marches on its stomach.” In today’s highly digital and electrified world, the military also marches on its power supply — a supply now under immense threat. The U.S. electric grid must withstand thousands of annual cyber-attacks by sophisticated hackers while it also faces increasingly extreme weather and a once-in-a-generation strain due to rising demand. It’s time for mission-critical sites to think outside the grid.

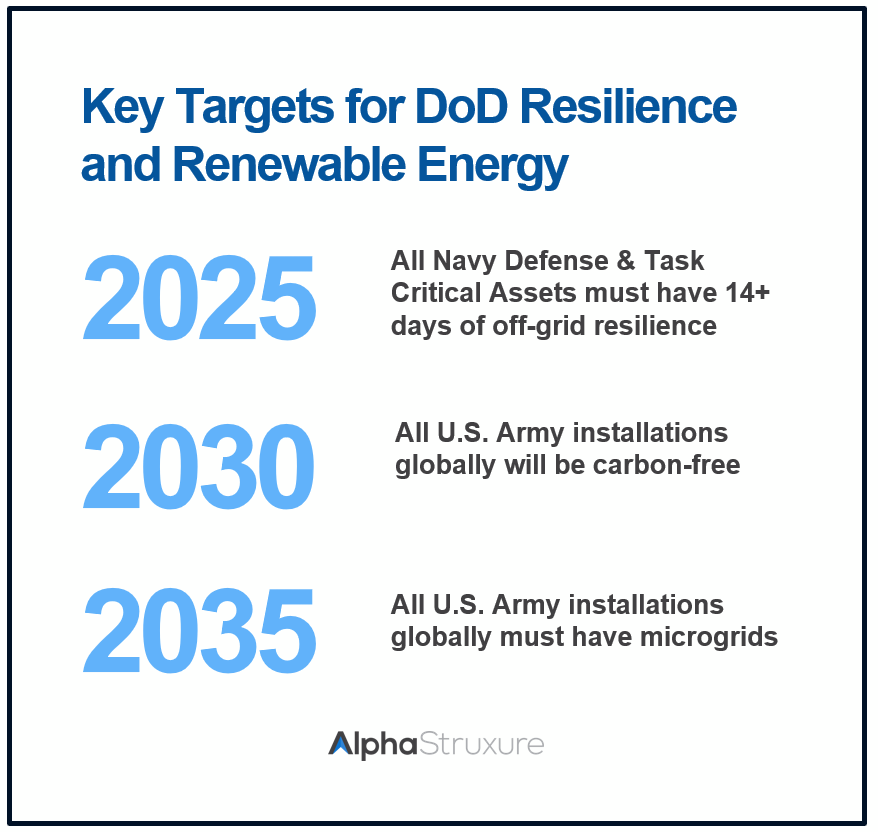

The U.S. Department of Defense (DoD) understands this, and it’s directing its installations around the world to undergo massive energy transformations. Its recent policies set ambitious targets around resilient power and renewable energy for its 350+ global bases. (See graphic)

In the past, the DoD used diesel and gas generators to provide off-grid power resilience. But now, with renewable energy targets looming, fossil fuels must take a backseat to solar arrays, battery storage, and emerging distributed energy resources (DERs) that provide clean firm power, such as hydrogen fuel cells. These DERs must all work in concert with one another within a larger system called a microgrid.

New DoD Policy Pushes for Deploying Microgrids at Speed and Scale

Recent DoD policies will spur a wave of hundreds of microgrids popping up at installations around the world. The technical and financial scale of this effort is massive, with billions of dollars and the mission-readiness of the military at stake. But a big question so far has been how to procure and deploy microgrids at speed and scale. With a lack of MILCON (Military Construction) and ERCIP (Energy Resilience Conservation Investment Program) funding, public dollars alone won’t achieve the mission — which is why Army and Navy policies call for third-party financing. To that end, this article shares a procurement pathway for privately financed microgrids delivered via Energy as a Service.

Here’s a look at recent guidance from the DoD and its branches:

- The DoD 20233 sustainability plan “strongly supports the deployment of sustainable, clean energy technologies to support installation resilience” and recognizes that an “enhanced use lease” can be used to “construct a microgrid that increases resiliency for the installation.”

- The Department of the Army’s 2022 Climate Strategy calls for “a microgrid on every installation by 2035” and to “better leverage third party financing.”

- A 2023 Department of the Navy memorandum noted the critical need to establish a “pathway for deploying cyber-secure microgrids at all DoN installations where Task Critical Assets (TCAs) and DoD Critical Assets (DCAs) reside.”

- And, further, the Navy “shall implement third-party financing authorities to contract for at least $1.25 billion in utility capital improvements, energy conservation measures, and increased resiliency by the end of calendar year 2027.”

The bottom line: Both the Army and Navy are calling for microgrids to be built using third-party financing. So now the question is, “How?”

How the DoD Can Use Private Project Finance to Deploy Microgrids

Private project finance and microgrids are both newcomers in the DoD infrastructure world. The good news for the DoD is that it’s not starting from scratch; there are current deal structures, private equity & debt finance options, and existing procurement authorities to build from.

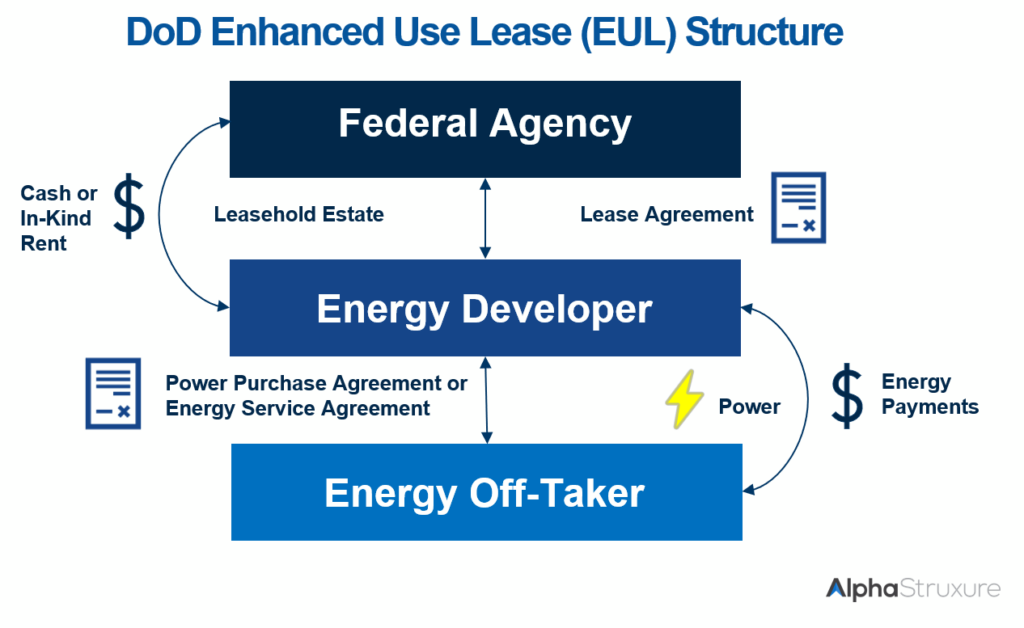

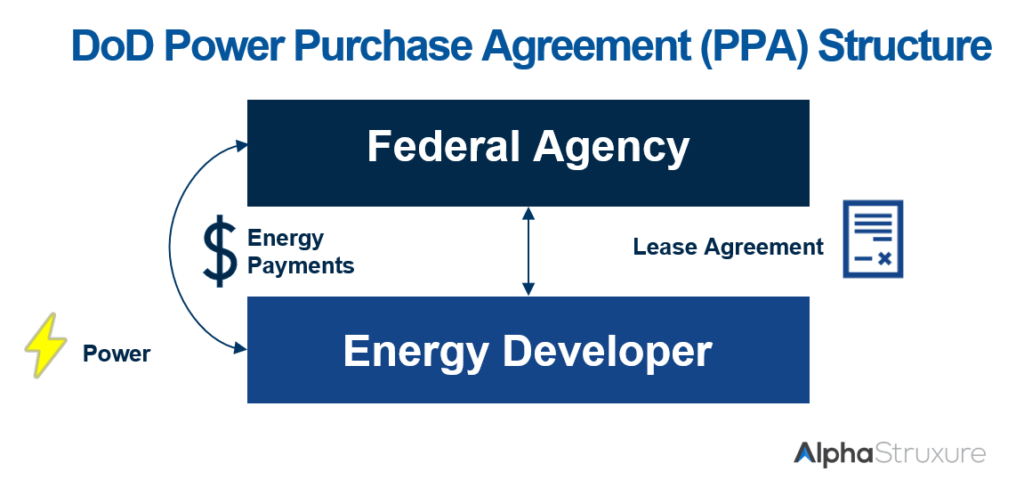

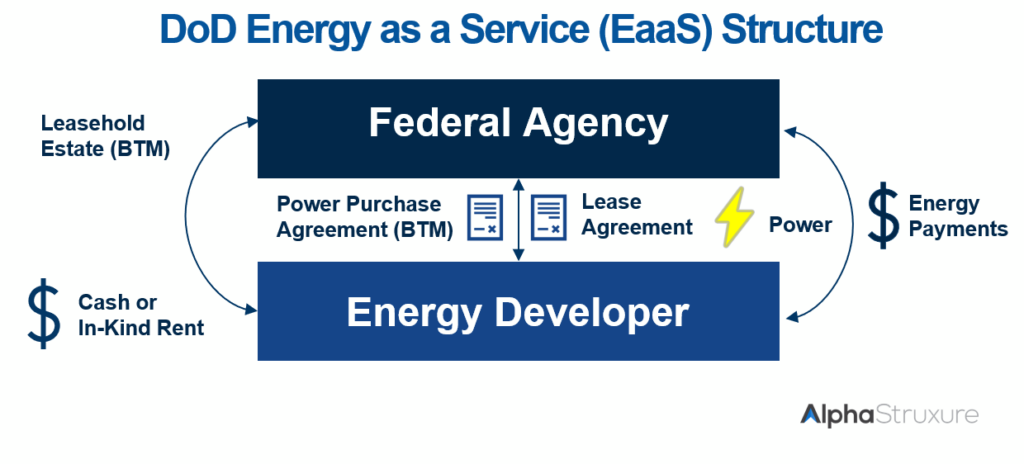

As of October 2023, there were about 30 microgrids operating at U.S. military sites. The DoD today uses a lease, which is often referred to as an enhanced use lease (EUL), and power purchase agreement (PPA) for green energy and microgrid projects. Based on those existing statutory authorities, Energy as a Service (EaaS) microgrid projects can be procured using the EUL and PPA statutory authorities. Furthermore, EaaS would enable the DoD and the energy developer to avoid significant obstacles presented by the first two approaches, thereby accelerating progress toward DoD policy goals. The energy deal structure diagrams and analyses below compare and contrast how these models work.

Comparing EULs vs. PPAs vs. EaaS

Enhanced Use Leases. The revenue risk lease deal structure is similar to a development ground lease in the commercial real estate sector. The DoD sometimes refers to this beneficial lease arrangement as an Enhanced Use Lease, or EUL. Here, the federal agency is the lessor and the energy developer is the lessee within the lease, and the developer must provide fair market value rent or other in-kind consideration. The agency then grants the developer a leasehold estate on federal property for the duration of the term. Although the developer may sell energy to third-party off-takers, no federal payments to the developer are permitted — for energy or otherwise. This fundamental characteristic has two drawbacks.

- Project Viability: The energy developer must secure a revenue stream from third parties and is at risk for revenue shortfalls. Consider that many bases are in remote areas where there may be few third-party off-takers.

- Financial and Location Constraints: The at-risk revenue stream may negatively impact finance rates and bankability. Thus, each microgrid could only be installed at locations with sufficient credit worthy third-party off-takers, and finance options may be limited or non-existent.

Power Purchase Agreements. In the utility space, for both public utilities and renewable energy independent power producers, the power purchase agreement (PPA) is a common way to sell energy to customers. The primary benefit of this model for the DoD is its simplicity. The energy developer sells electrical energy to the federal agency in exchange for utility payments, and the developer provides the financing, real property, design, construction, and operation & maintenance. There are, however, two drawbacks to the model.

- Resilience: The companies executing PPAs with the DoD typically rely on the same utility grids that have weather, capacity, and cybersecurity resilience problems, so relying on electrons from the PPA developer is essentially relying on the grid, and this presents resilience risks.

- Exposure to Price Volatility: Depending on the PPA rate structure, the DoD may be subject to high rate escalations each year. For example, one rate case application filed in California seeks a 23% rate increase in 2025. In any event, though the simplicity of the deal structure is beneficial, the resilience and rate drawbacks are substantial.

Energy as a Service. The Energy as a Service, or EaaS, deal structure combines the EUL and PPA models. Broadly speaking, it combines the on-site infrastructure leasing component of the EUL with the energy purchasing component of the PPA. The EaaS model thus combines the resilience benefit of an on-site microgrid with the capital avoidance, green energy, and fixed energy costs enabled by PPAs. EaaS is a way for federal agencies within the DoD to partner with an expert in financing, designing, building, operating, owning, and maintaining on-site energy infrastructure. It has the advantage of harnessing the benefits of both conventional approaches while avoiding their drawbacks. Here’s how the Energy as a Service model works:

- The EaaS energy developer first enters into a lease with the federal agency to finance, design, build, operate, and maintain an on-site renewable energy microgrid on federal property, and the developer provides consideration for the leasehold estate.

- Next, the developer and federal agency execute a PPA between the developer and agency that permits the developer to provide energy services in exchange for agency payments, which begin at commercial operations.

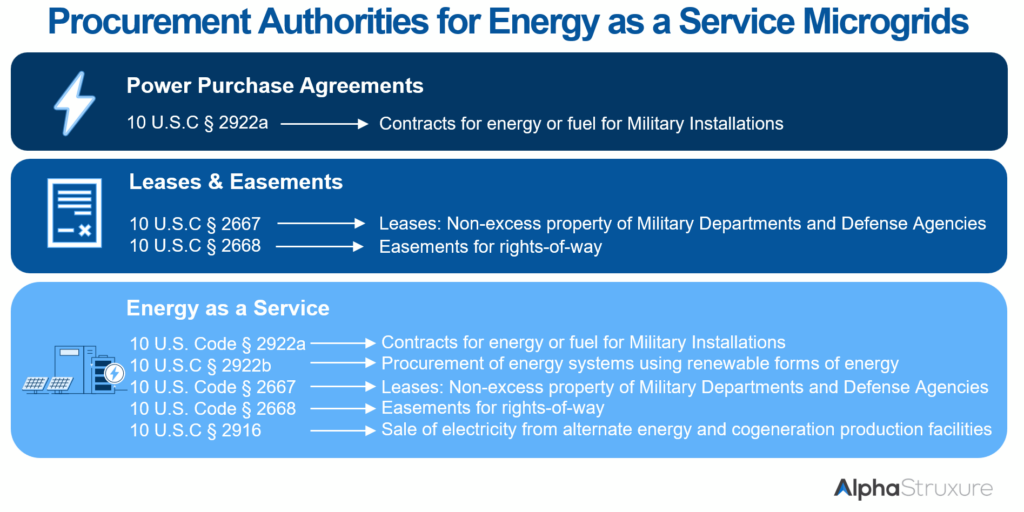

In simplistic terms, Energy as a Service is the logical result of combining two existing procurement authorities, EUL and PPA. Here are the statutes used to build this analysis:

What EaaS Does that EULs or PPAs Alone Can’t

This solution optimizes the benefits to the energy developer and federal agency — without the standalone EUL or standalone PPA drawbacks. Under a combined EUL/PPA (or EaaS) arrangement, the parties can locate microgrids where they’re needed the most, instead of only where developers can negotiate third-party off-taker agreements. Second, the PPA provides for an energy services payment, which escalates at a contractually agreed fixed rate per annum. This fixed payment provides a guaranteed revenue stream for the developer but one that is lower than public utility costs over the term. The EaaS model also provides bankability with decreased risk premiums of third-party financiers. And of course, microgrids (unlike PPAs with grid electrons) provide on-site generation and resilience for mission-critical installations

How to Harness Project Finance to Deploy Microgrids via Energy as a Service

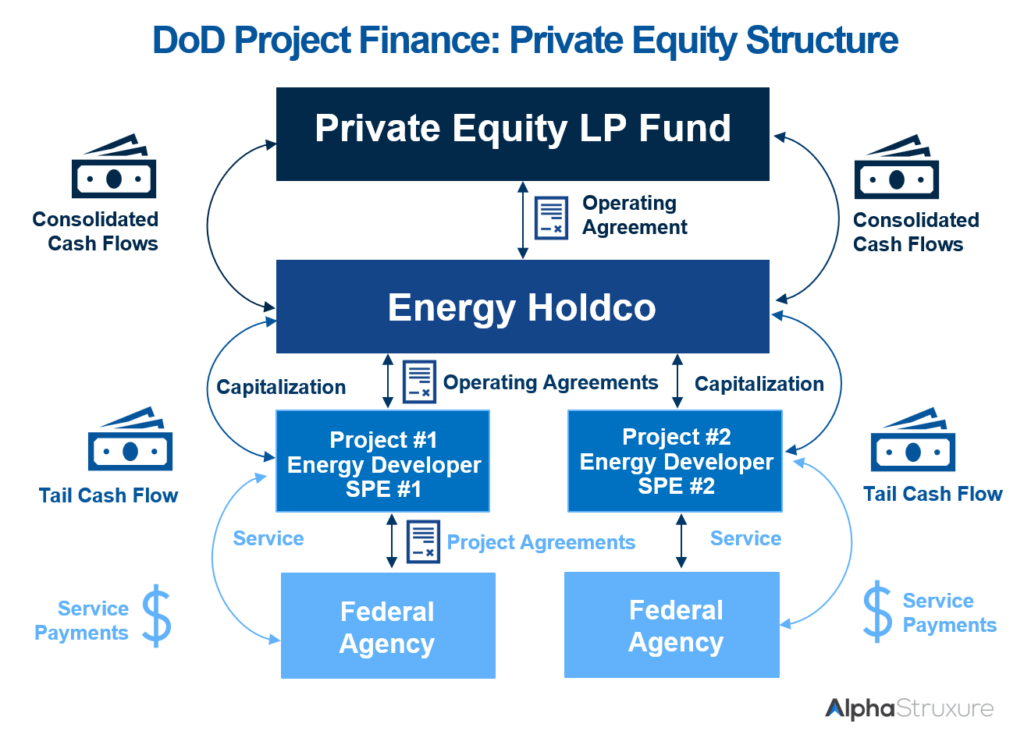

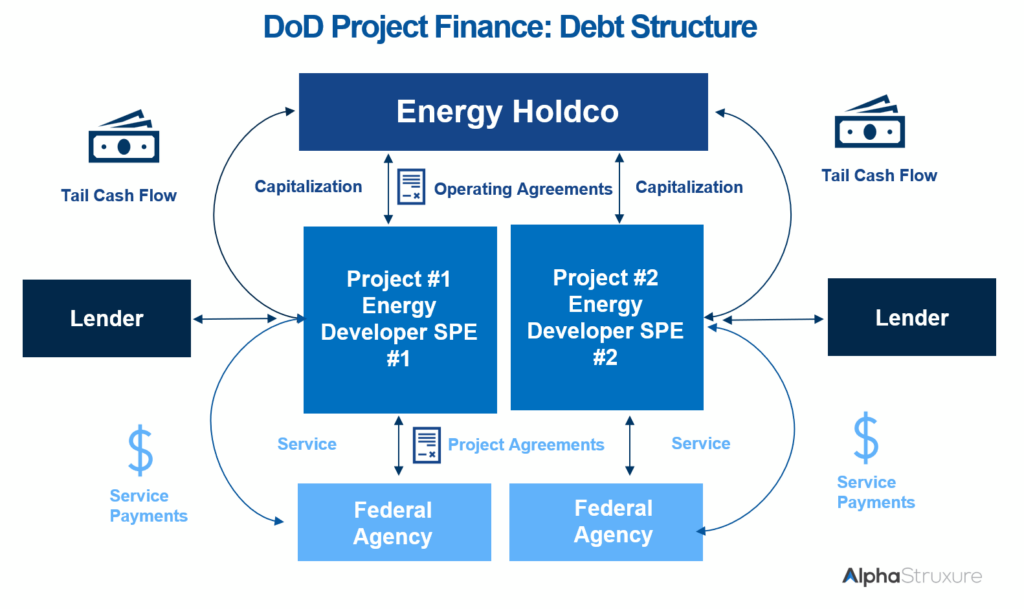

Now that we’ve established the basis for Energy as a Service procurement authority for the DoD, we can also bring in third-party financing for DoD microgrid projects. Doing so frees up the limited MILCON (Military Construction) and ERCIP (Energy Resilience Conservation Investment Program) funds for other projects. Although there are a number of project finance capital stack arrangements, we will focus on private equity finance through a limited partnership and debt finance through a lender.

The first source of EaaS project finance that we’ll discuss is private equity from a limited partnership fund. Here, the energy developer first mobilizes a special purpose entity, or SPE, as the agency counterparty to design, build, own, operate, and maintain the project. The SPE is typically a subsidiary of an energy holding company, or Holdco, which is wholly owned by the private equity limited partnership fund. The fund capitalizes the SPE, and the SPE uses these funds for the project costs. The cashflow begins with the federal agency energy service payments to the SPE. After the accounts waterfall, payments made for SPE operations costs, the remaining funds (tail cash flow) moves to the LP fund through the Energy Holdco.

The second source of EaaS project finance that we will discuss is debt. Debt may come from a commercial bank, a bank syndicate, or institutional investors, such as asset managers. As with the prior private equity finance structure, the energy developer mobilizes an SPE that is a wholly owned subsidiary of an Energy Holdco. Here, however, the Energy Holdco is a wholly owned subsidiary of the Energy Developer — not a private equity LP fund. Also, the SPE borrows directly from a debt lender instead of being capitalized with private equity. With debt project finance, the cash flows from the federal agency to the SPE and through the SPE waterfall. The tail cash flow moves to the Energy Holdco after each distribution and then to the Energy Developer.

Conclusion & Executive Summary

No doubt, there’s a lot of information here. So, to summarize: DoD policies are calling for both more resilient and renewable microgrids and more third-party financing to deploy them. This article presents a way to do both, via Energy as a Service.

- Procurement Authority: EUL + PPA = EaaS.

Deploying microgrids is a key resilience objective for the DoD. Existing EUL and PPA procurement authorities for microgrids can be combined into an Energy as a Service procurement model. The EaaS model draws from the EUL’s authority to execute land leases for the siting of energy infrastructure (microgrids) on DoD installations. It also draws from the PPA’s authority that enables a energy developer to contract with a DoD agency by selling energy in exchange for its services in financing, designing, building, owning, operating, and maintaining energy infrastructure.

- Private Financing Options: Private Equity and Debt

EaaS brings in third-party financing to deploy microgrids, a stated goal of both the Army and Navy. This article shares two ways to finance an energy project, although there are others. Both sources, private equity and debt, involve SPEs to make the deal work. Both can help the DoD deploy more microgrids in the face of constrained MILCON and ERCIP funds.

Next Steps and Proven Partners

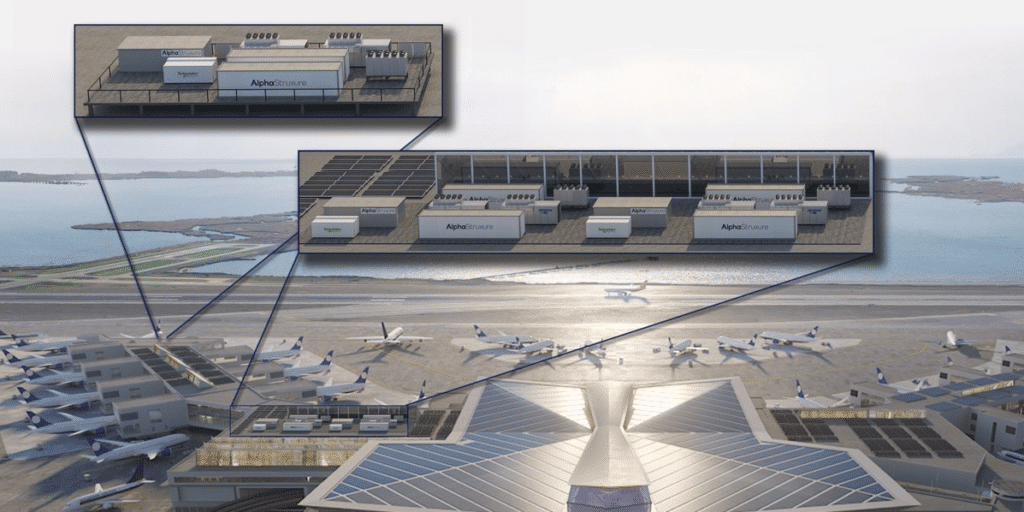

The next step in pursuit of DoD microgrid objectives is to find trusted partners to join you. AlphaStruxure, a Carlyle and Schneider Electric company, has deployed some of the largest, most complex microgrids in the world. We’re deploying an 11.34-megawatt microgrid at JFK International Airport’s New Terminal One that will power 100% of the terminal’s critical operations and features the largest rooftop solar array on any U.S. airport.

We also have two projects with Montgomery County, MD, just outside Washington, D.C. Together, these two microgrids will transition 270+ buses to electric and hydrogen. We deployed Brookville, the first project, currently the country’s largest transit depot microgrid, in just 13 months. The second microgrid project, EMTOC, will power three times more zero-emissions buses than Brookville and produce green hydrogen on-site with an electrolyzer.

All our projects are equipped with Schneider Electric electrical equipment and cyber-by-design software certified yearly by a third party to NIST 800-53 and IEC 62443 standards. Schneider has built several microgrids at military bases around the world, including Marine Corps Air Station Miramar and, most recently, a $406 million project at Yokota Air Base featuring a microgrid, which will save $12.3 million per year, at no upfront cost to taxpayers.

As the DoD embarks on an ambitious energy transformation, it will need partners ready to operate at speed and scale, with safety and cybersecurity in mind. AlphaStruxure stands ready to support this mission. I encourage you to reach out to me using the form below to talk more about Energy as a Service procurement with the DoD and other federal agencies.