Cement is, quite literally, the foundation for society. Used to build almost everything, from schools and homes to roads and bridges, cement is the most ubiquitously manufactured product in the world and the second most widely used material globally—after water. Demand for the material dates back some 2,000 years and tends to rise in line with periods of rapid population growth. Over the last half century, global demand for cement has increased nearly sevenfold with development and urbanization. Looking ahead, demand is projected to increase 42% by 2040, according to some estimates.

Cement production has long yielded a disproportionate share of global CO2 emissions due to the energy intensive nature of its operations. In fact, recent studies attribute 8 percent of global CO2 emissions to the cement industry; for perspective, if the cement industry were a country, it would rank number three in emissions—behind China and the United States. Heightened pressure to take measurable aim at decarbonization, however, has stakeholders stumped.

So, how does a centuries-old industry reinvent itself in a matter of years? Net-zero pledges from groups like the Global Cement and Concrete Association are well and good but the reality of achieving these goals is incredibly complex and the cement industry cannot go it alone.

New EaaS models offer cement producers an attractive means to decarbonize. Similar to the way Software as a Service (SaaS) companies disrupted many aspects of enterprise business, EaaS offers organizations a trusted way to manage and consume clean energy. Third-party providers take on the development, financing, ownership and operations of onsite energy solutions tailored to the plant’s needs, while manufacturers remain laser focused on their core business operations.

Here’s how and why it matters:

Go after the low hanging fruit

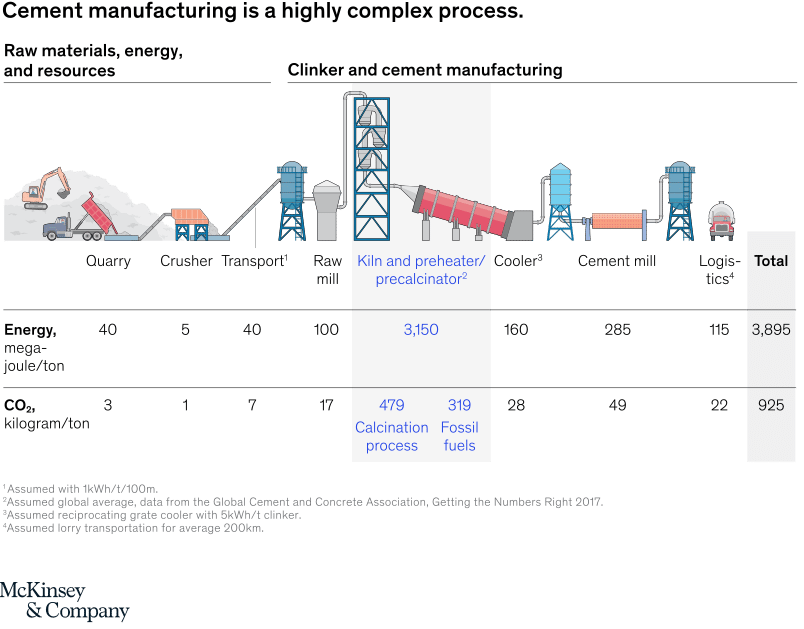

Decarbonizing cement is challenging due to the nature of its manufacturing processes andrequirements for high-intensity thermal energy. Roughly 60 percent of CO2 emissions are a byproduct of the calcination process in the kiln, while the remaining 40 percent come from energy and fuel consumption. An effective strategy, therefore, must tackle the major sources of carbon from the kiln while prioritizing commercially available and cost-effective greenhouse gas reduction measures.

Carbon capture and sequestration has the greatest potential for reduction, but the deployment of this technology at scale is still five to ten years out and forward-thinking cement producers beg solutions now. Without interim reductions, the cement industry would be hard pressed to achieve greater than 20 percent emissions reduction by 2050, according to estimates from McKinsey.

One ready-available approach to decarbonization is to replace the fossil fuels used to fire the kiln with low carbon fuels from agricultural and dairy waste, like pistachio shells or cow manure. Waste fuels can be used to generate a biogas capable of directly powering the kiln as well as provide dispatchable baseload generation, offering cement manufacturers multi-day resilience in the face of worsening forest fires or extreme weather events.

Advancements in intelligent control systems make it possible for cement plants to run on local power systems known as microgrids that consist of distributed generation, batteries, renewable energy sources, and low-carbon fuels. Energy produced and stored on-site allows plants to run independent of the local utility and can also be tapped to support the grid in the event of a power outage or safety shutoff. The microgrid optimizes how and when different types of generation are used; for instance, electricity from on-site solar or storage can power a plant’s peak demand, while low-carbon biogas can be produced from waste to power the carbon-intensive kiln.

Show me the money

The United States’ preferred climate policy allows local regulators to set a cap on emissions while taxing companies that surpass that number and rewarding those that fall below it by allowing them to sell or trade their pollution credits. Take California, for example, which has one of the nation’s longest standing Cap and Trade programs. If a cement plant in California were required to purchase 100,000 tons of carbon credits to meet their cap, then the cost of compliance would sky-rocket from $1.8M (at today’s carbon price of $18/metric ton of CO2) to $5M by 2030 (at a projected carbon price of $50/ton).

Because cement producers compete primarily on price, the cost of compliance with these programs is a significant challenge for industry, as reducing emissions often incurs costly capital investments that can hurt a manufacturers’ standing in the marketplace. Any truly impactful decarbonization strategy must carefully balance the nuances of the product.

With EaaS, cement producers can leverage third-party financing to help fund decarbonization measures that reduce greenhouse gases and mitigate costs of compliance. Moreover, EaaS solutions guarantee output and performance from onsite energy sources capable of enabling new revenue streams, from the $300 billion market demand for green cement, as well as lessening the risk of implementation.

But wait, there’s more

The nation’s infrastructure is in desperate need of repair and, when considered against various levers for decarbonization, both regulatory and market-driven, EaaS solutions not only offer a competitive advantage, but the benefits to energy resilience and reliability provide a much needed layer of defense against extreme weather events and increasingly frequent power outages resulting from grid failures.

Even a microsecond of an outage or the smallest fluctuation in power quality can result in equipment shutting off, wasted product, or equipment damage, causing tens of thousands of dollars in lost revenue. A sustained outage due to downed transmission lines or a public safety shut off event could incur an opportunity cost of $20,000 per hour for outages less than six hours. Once the interruption exceeds six hours, the site could incur a single $250,000 cost as a result of the kiln cooling down, plus $20,000/hr for the duration of the outage. A properly designed microgrid mitigates these costs by sensing and protecting against power outages, seamlessly transitioning electrical loads from the utility to on-site resources.

Conclusion

Demand for ESG-focused investments has grown markedly in recent years amidst growing environmental, social, political and financial pressures. Across the board, from retail owners to manufacturing plants, a company’s well-being is dependent upon its ability to make defensible ESG investments. For heavy emitters, like cement, however, committing to net-zero standards is much easier said than done.

To meet net-zero carbon targets by mid-century, the cement industry must reduce the thermal energy intensity of the kiln by 0.7% per year to a global average of 3.1 GJ/t by 2030. EaaS solutions that prioritize the price-sensitive nature of the commodity and limit the need for costly capital investments while guaranteeing performance is a win-win for cement players and the planet.

Consider this: Approximately 75 percent of global cement is purchased by government entities. As countries, states and municipalities set their respective decarbonization strategies, future procurement specifications will, undoubtedly, prioritize low carbon and green cement. Those that act early face an obvious advantage.