One year ago, the Inflation Reduction Act became law. Today we celebrate not only its anniversary, but also its immediate impact: hundreds of billions of dollars are now flowing to decarbonization and electrification projects around the country.

At AlphaStruxure, we’re seeing first-hand how much the IRA is changing the game. It’s bringing the costs down for all kinds of clean energy projects, including Energy as a Service microgrids.

There’s a common theme throughout this legislation that resonates with us here at AlphaStruxure –and to our clients: accelerating the energy transformation. Let’s dig into some of the details on the IRA incentives for microgrids, advanced manufacturing, electrified transit, buildings, and renewable energy, and what they mean for you.

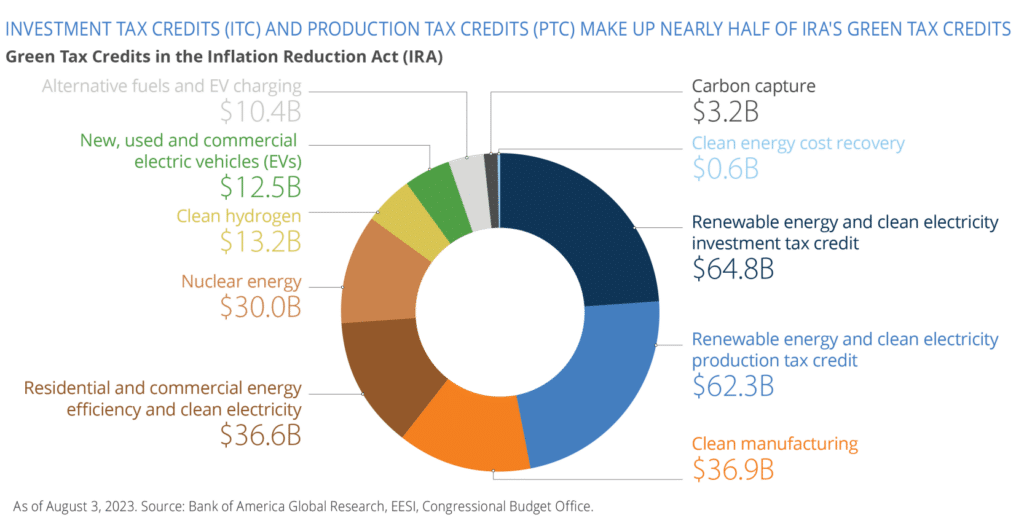

A big boost for microgrids: The bipartisan Infrastructure Investment and Jobs Act (IIJA) that became law last year was a big win for microgrids because it provided grant funding to enhance grid resilience, upgrade distribution systems, and integrate distributed energy resources like microgrids. The IRA goes much further by opening up tax credits that have been reserved exclusively for renewable energy technologies. The legislation expands the solar Investment Tax Credit (ITC) to include both microgrid controls and components, including energy microgrids, storage technology, biogas property, microgrid controllers, and linear generators. These technologies are eligible for a six percent credit or a 30 percent bonus credit for any qualified projects that begin construction before January 1, 2025.

IRA tax incentives coupled with the innovative Energy as a Service microgrid model accelerate renewable energy projects that strategically deploy public and private capital to meet localized resilience and sustainability goals.

Incentives for clean commercial and heavy-duty vehicles: There’s been a lot of interest on the consumer EV incentives in this legislation. However, there’s also strong incentives for clean commercial and heavy-duty vehicles. This legislation creates a new tax credit for qualified commercial electric vehicles. The provision provides a business tax credit of up to 30 percent for certain commercial clean vehicles with a per vehicle limit of:

- $7,500 for vehicles less than 14,000 pounds, including light-duty vehicles such as vans, city delivery trucks, and box trucks;

- Up to $40,000 for vehicles over 14,000 pounds, including medium and heavy-duty trucks, transit buses, and long-haul tractor-trailers.

State and local governments receive direct grant support through a $1 billion fund dedicated to heavy-duty vehicles such as electric school and transit buses and garbage trucks. That support is in addition to the $60 million the EPA will receive to electrify vehicles at airports, railyards, and distribution centers and the $3 billion to make our maritime ports clean and electrified.

Bottom line: As this legislation is implemented, municipalities and businesses will need a significant amount of resilient charging infrastructure to meet the increased demand for sustainable energy to power electric vehicles.

Accelerating advanced manufacturing: Responding to supply chain shortages and inflation, this legislation heavily emphasizes domestic manufacturing, including facility modernization and decarbonization. The legislation provides grant funding for a range of programs that cover the costs of energy upgrades to reduce emissions at manufacturing facilities, including:

- Low- or zero-carbon heat systems

- Carbon capture transport, utilization, and storage systems

- Energy efficiency and reduction in waste from industrial processes

- Technology designed to reduce greenhouse gas emissions

- Re-equipping, expanding, or establishing an industrial facility for processing, refining, or recycling critical materials

Buildings: The expanded commercial tax credit for energy efficiency improvements will expedite the energy transition of the country’s buildings, which will create healthier and more productive indoor environments. Commercial buildings aren’t alone in benefiting from the IRA ― schools and public housing are set to receive millions of dollars to transition their energy infrastructure. As we consider ways to control and optimize energy, integrated energy consumption is a logical and effective first step.

Adoption of renewable fuels: One of the challenges our customers face in considering how to reduce their carbon footprint is finding a suitable and economical substitute for natural gas and diesel. These alternatives must have the same energy density requirements and technical capabilities ― the ability to be turned on and off, and/or used in high heat processes, like cement, glass, or steelmaking. Electrification isn’t a one-size-fits-all solution, and this bill recognizes the need to expand excise tax credits for biodiesel, renewable diesel, and other alternative fuels.

Regardless of whether it’s a tax credit or a grant, this legislation will encourage both the private and public sectors to take the next steps to decarbonize facilities, incorporate microgrid controls, and deploy EV fleets. A grant and/or tax credit, combined with our Energy as a Service (EaaS) business model, means these projects make even more economic sense and put ambitious sustainable goals within reach.

At AlphaStruxure, we can incorporate all available grants and tax incentives, further reducing long-term costs for our clients. We’re excited to be a turnkey partner to help our customers accelerate their energy transformation journey.

If you’re interested in learning more about how AlphaStruxure can partner with your organization to achieve your sustainable energy goals, reach out to our team at info@alphastruxure.com